“I don’t want to buy any car, even though I can afford it. Who will worry about the parking, maintenance, and Delhi’s pathetic traffic? For me, cab aggregators are a blessing, with no capital investment, no mental tension.” Jay, 32, Gurgaon

“For me, bike share is enough, I can call them any time I want. Extremely quick and cheap, much better than cars and auto.” Adi, 25, Hyderabad

“My office is 35 km from my home, sometimes it takes almost 2 hours to reach. With carpool apps, rideshare, my urban transport has become so much better, I can read books, work on my laptop, sleep or even make friends.” Priya, 28, Bengaluru

“Earlier I used to go to my college on the road transport buses, which was always chaotic, delayed, dirty and packed with people. Now I go to the metro train, which is so comfortable and fast.” Kumar, 18, Lucknow

Over the past year or so, voices like these have become increasingly common among India’s urban dwellers. These opinions come from a few big cities but are resonated with many other people, especially from the corporate world.

Indian auto industry had a forgettable 2019, plummeting sales of all the car and bike companies, declining market capitalization, factory shutdowns, and job losses were part of daily news updates. As per the data from, Society of Indian Automobile Manufacturers (SIAM), vehicle sales across categories declined by 13.77 percent in January- December 2019.

What are the Reasons?

Don’t want to go into the economics side of things, market forces are there to determine that, there are few other indications, which we feel kept people away from buying a car.

Traffic Congestion

Many of the Indian cities are chockablock with traffic, whether it is due to bad driving, inefficient traffic management, illegal parking, potholes or encroachments — most of the time driving on Indian roads is a nightmare.

As per a report from TomTom traffic index 2019, which ranks urban congestion covering 400 cities across 57 countries. There are 3 Indian cities in the top 10, in terms of congestion levels — Bengaluru leads the worldwide charts, followed by Mumbai at 4 and New Delhi at 8th rank. A 71% congestion level in Bengaluru, means that a trip will take 71% more time than it would during non-congested conditions. If we look at only those cities with more than 8 million population, then Bengaluru and Mumbai are the top 2.

Instead of being stuck behind the wheel and wasting time — the new age commuters watch episodes of Netflix or play a car racing game rather than driving the car themselves.

Mindset shift

There was a time when youngsters in their early 20s, as soon as they were close to financial stability, would fling to car showrooms — buy an EMI assisted vehicle. Owning a car/vehicle was considered a status symbol and an acknowledgment of reaching a position in life.

This has changed; the new younger lot do not like to drive their personal cars — reach their respective destination — completely drained and stressed after driving for hours in terrible traffic conditions. They would prefer to sit in the backseat of a vehicle with their headphones on and their smartphones by their hand.

C — Cost, Comfort, and Convenience

- Cost -Not owning a car or vehicle, saves people from unnecessary financial burden.

- Comfort — in a stressful life, people are looking for peace of mind rather than the ego boost of owning a car.

- Convenience — Lastly, when you can call a chauffeur-driven transport in the middle of the night to take you anywhere, is there really a need to buy a mobility product?

Gig Economy

While the focus is mostly on the consumer side, the drivers of the supply market are also changing (quite literally). Whether it is an allure of extra money or being financially independent, there are a lot of people who are making their own path. Yes, we are referring to the cab and bike drivers who are supporting this economy.

If people are not buying vehicles, then what’s happening?

One thing is for sure, Indian’s might not be buying Marutis, Tatas, Mahindras, Toyotas, Bajajs of the world, but they sure are traveling. It’s not that people sit at home, or they have started to take walks to reach their destinations — they do use some form of transport. The earlier typical modes — cramped buses, overpriced private cabs which were dictated by whims and fancies of drivers — is now transformed into smarter and more effective form. The disruption is mostly driven by new-age Indian startups, that are efficiently bridging the gap between vehicles and commuters and make people’s lives and transportation much easier.

The options can be divided into 2 broad categories — 1. Those vehicles have a limited capacity like cars, auto and bikes and 2. Those who have bigger capacity like buses, mini-buses, and trains. Let’s look at the options.

Taxi-hailing companies and Cab Aggregators

The idea of India’s biggest cab aggregator — Ola, was discovered when its founder was left stranded in the middle of a road in Bangalore by a cab driver. In 2010, Ola became the pioneer in offering technology-enabled transport services, the company partners with drivers and cab owners to offer cab services to people across cities and towns.

A few years later, the Indian roads welcomed a foreign guest in the form of a US-based billion-dollar ride-hailing giant Uber, which is Ola’s biggest competitor. In the last 4–5 years, Ola and Uber have completely transformed the driving habits of the urban commuters, people don’t have to go out on the roads and fend for a transport option. People can simply book their rides from the comfort of their homes on their mobile phones.

A survey of 1000+ commuters in Delhi NCR by Consumer Unity and Trust Society (CUTS) International, revealed that 35% of people commuting have cab booking apps as the most frequently used mode of private transport.

Used Car

While the craze of buying new cars is going in the reverse direction, demand for used cars is going upwards. Rising disposable incomes and cheaper finance options are allowing consumers to buy second-hand cars. In 2018–19, while new car sales were recorded at approximately 3.4 million units, 4 million second-hand cars were bought and sold, according to a recent report on India’s pre-owned car market by IndianBlueBook.

If we look at the developed nations of the world, the ratio of people buying a new car and a pre-owned car is 1:3, meaning out of four people who buy a car, only one buys a new car and three settles for a used car. While in India the ratio is more around 1:1, but growth is giving a good indication of the changing dynamics. According to the IndianBlueBook report, only 18% of the used car market is under organized channels, as of 2018–19, up from 15% two years ago. This growth is driven by increased sales of used cars in metro cities and a rise in online sales platforms.

Major investments are flowing into the market. Some of the major players dominating the market are CarDekho, Droom, Olx, Mahindra First Choice Wheels, Cars24, Maruti True Value, Hyundai H Promise, and many others — who are offering an online marketplace for people who want to buy a used car. These companies not only provide a common platform for sellers and buyers but also give the buyer an assurance on vehicle quality and reliability.

Car Rental

Car rental service has come a long way since 2013, when Zoomcar, became India’s first company to offer self-drive car service. The lure of driving a car, that too of any choice, has made the car rental business a promising one. The growth is more than 10–15% and the market is expected to reach USD 15 billion in the next 2–3 years.

Bengaluru based Zoomcar, with a presence in around 30 cities and more than 3000 rides per day are the leader of the pack. Myles, with a presence in 20+ cities and various car models, is following closely. Revv is present in approximately 20 cities, MyChoize in 15+ cities and Carzonrent in 10+ cities.

Such is the impact, and the market potential, that 2 dominant players in cab aggregation business Ola and Uber have also joined the fray.

Bike aggregators

Bangalore based Bounce is the world’s fastest-growing bike-sharing startup, a feat it achieved within 10 months of launching dockless scooters. Offering last-mile connectivity to urban dwellers, the start-up claims to clock about 100,000 rides per day; this puts it at par with US-based scooter-rental companies Lime and Bird.

Bounce’s rival, Vogo, formed a strategic partnership with Ola, where the ride-hailing giant will boost Vogo’s supply by investing in 100,000 scooters on the Vogo platform, worth $100 million. Its offerings will be available for Ola’s customer base of over 150 million, directly from the Ola app.

Rapido, another promising startup in this space, has over two million customers and a presence in 40 cities in India. Then there is a list of bicycle rental startups, like ONN, Yulu, and Mobycy — all of whom have slowly moved to bikes and e-bikes. Yulu, with more than 14,000 vehicles is India’s largest electric vehicle platform.

Car Pool

Another interesting phenomenon is car and bike pools, where the rider offers the extra seat to other commuters who are following the same path. Bengaluru based Quick Ride with a presence in 8 cities claims to have more than 2 million users. Other players in the market are UberPool, ToGo, Ryde,

Mass Commute

Cabs are good and fancy, but they are expensive as well and not everyone can afford them on a daily basis. Relying on public transportation is a disaster as intra-city public transport is overcrowded, unreliable and the vehicles are in shambles. The alternative came in the form of a concept that lets customers reserve a seat on a bus/minibus through technology.

Shuttl, which calls itself as “India’s largest office commute service provider” assesses the times when the demand for travel is the highest and more often than not, it is when people go and return from their offices. So, Shuttl offers time slots during which individuals can reserve a seat on a bus. The reservation for the particular time slot remains open until all the seats are booked.

Urban Rail Transit

While all the above were driven from the private/start-up sector, this one is primarily Government-sponsored but supported by large infrastructure companies. We have come a long way in terms of the urban railway transit systems and more specifically metro lines. In the last 10 years, India has seen tremendous progress in terms of metro growth. Currently, the metro system is operational in 20+ Indian cities, covering more than 650+ kilometers (397.00 miles) of operational lines. Over 25 cities are planning to put up a metro, thus another ~1,500kms of the network is at various stages of implementation with an estimated investment of ~$70 bn.

Electric Vehicles (EV)

Last but not least, the technology and commute which probably will redefine the automotive industry in a few years are Electric vehicles. In FY2019, total EV sales in India crossed the 750,000 units compared to 350,000 units in 2018. This includes electric two-wheelers (126,000), electric three-wheelers (630,000) and electric passenger vehicles (3,600).

One of the biggest driver for EVs is the cost, as per some calculations, the cost of running an electric car is about a quarter of a diesel car and the efficiency keeps improving with more miles EV covers. Looking at the massive opportunity, in 2019 March, Ola spun off its electric vehicles business into a separate entity and raised massive funding for its future growth plans.

Lithium Urban Technology, the country’s first company with a fleet of all-electric cabs. The five-year-old company is the largest EV fleet operator in India with more than 1,000 cars and has focussed its attention on transporting corporate employees with clients like Google, Wipro, and Barclays.

What are the Advantages?

We still have a long way to go, but if there are fewer personal cars and people rely more on public transport.

Smoother traffic and Lower Congestion

With average road infrastructure, poor road conditions, bad driving sense, inefficient law enforcement, encroachments, hawkers and animals enjoying their own space, we all know what happens. Traffic snarls, accidents are common sights, the average travel speed in the country is one of the slowest in the world. As per a MoveInSync report. On average, Indian professionals spend 7% of their day, or two hours, commuting — higher than people in most countries. Earlier, a report by location technology specialist TomTom said Mumbai’s traffic flow was the worst in the world. Bengaluru, India’s IT capital records 18.7 km/hour while our Financial capital, Mumbai is 18.5 km/hour.

The shift towards the new age urban mode of transport greatly eases the pressure of traffic on the roads.

Reduction in Import bill and Lower fuel spent

Though marginal, but reduction in a number of single-driver cars will help reduce India’s oil imports.

Carbon Emissions

The reduced use of personal vehicles and a paradigm shift from a petroleum-based fuel engine to Electric vehicles helps reduce the carbon footprint on the environment. The looming threat of climate catastrophe has made it imperative that we start adopting eco-friendly ways of urban transport. And thankfully, we are already witnessing a change in the mindset of the people for adopting fuel-efficient and public modes of transport.

Convenience

Huge discounts, intuitive interface, and contextual customer engagement are the major driving forces for people to opt for mobile app-based bookings. In addition, the comfort of air-conditioners, aerodynamic seating and personalized entertainment offers great delight to the commuters.

Startup ecosystem

With conducive policies, infrastructure in place and most importantly a ready & reciprocating customer base, it is for the entrepreneurs to step forward and create businesses that create a greener, healthier and inclusive economy.

Conclusion

In the end, one common theme emerges from the above is that digital technologies have empowered the customers to decide what they want to use, how to use when to use. The mobile phone penetration, plummeting internet charges have given fuel to a lot of sectors in the economy. Hence, it is no surprise that the transport sector has also taken this evolution in its stride and has created a new way of mobility.

How we started this story, would also end it by sharing thoughts from Suresh, 39 and Ayesha, 36 — a married couple, from Mumbai — on being asked why they don’t buy a car –

“Our grocery is getting delivered by likes of Big Basket and Grofers. Our shopping essentials are delivered by Amazon and Flipkart. Our food is getting delivered by Zomato and Swiggy. Medicines getting delivered while even things like chips and chocolates getting delivered by companies like Dunzo. My travel needs are taken care of by Metro, ride aggregators, rentals service. Why do I need to own a car or a bike?”

P.S: This article is just a primer on the changing dynamics in the industry, where each of the points can be presented in detail separately. Also, this is a personal opinion, with no justification on the economic side of things or to defend the Finance minister’s statement. I am sure, there are still a lot of people who would love the idea of driving their own vehicles, and would own one someday.

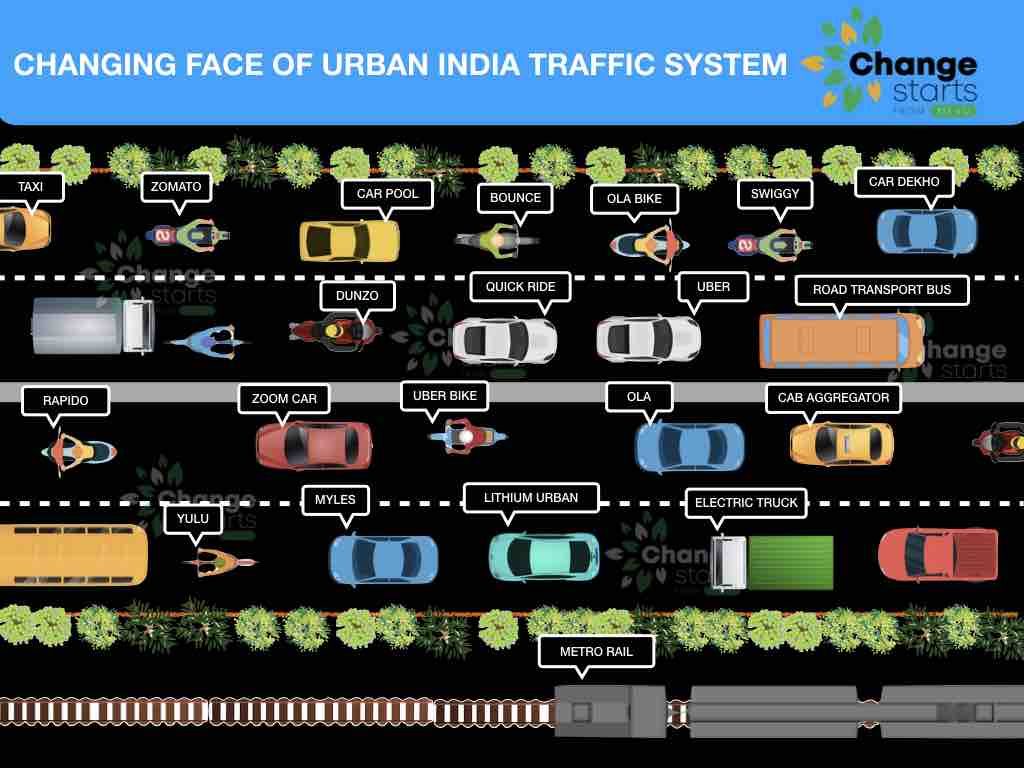

This is how the new Indian urban transport landscape looks (an illustrative representation, with no bias or affinity to any particular brand)

Add comment